By Lanka Securities Research

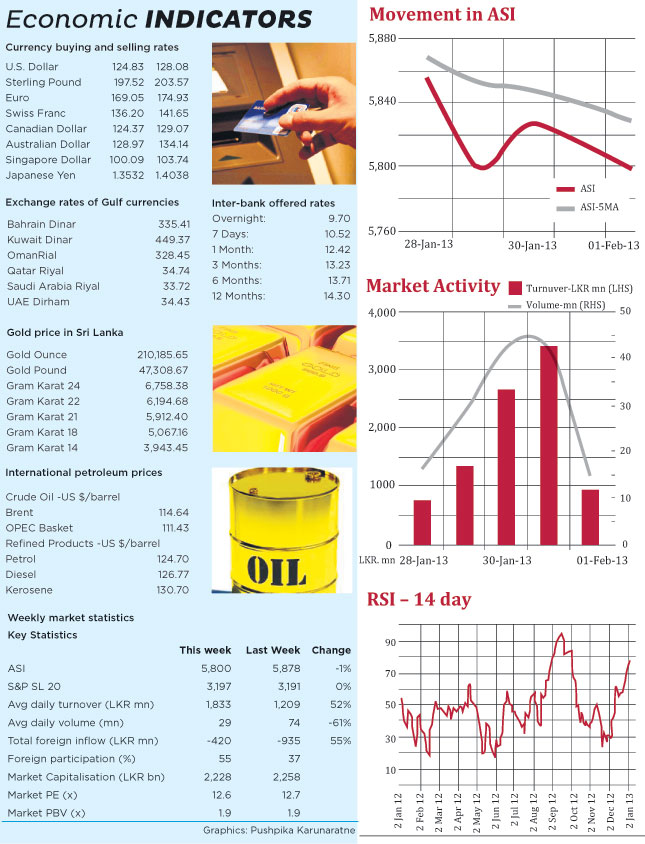

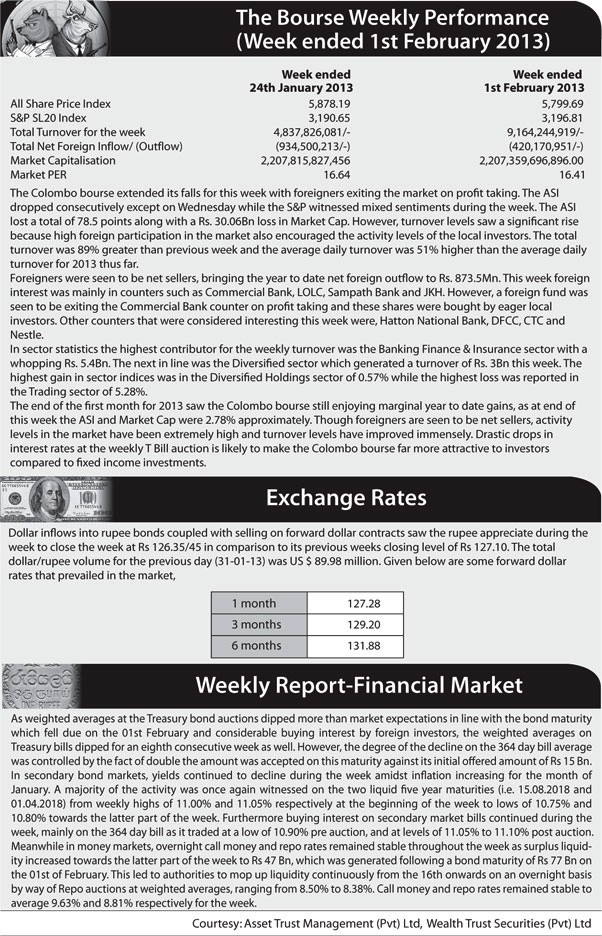

Profit taking on retail driven counters saw the broader index losing ground on Monday whilst gains on a handful of blue-chips saw the S&P SL20 index gaining marginally. Premier blue-chip John Keells Holdings dominated turnover contributing more than 72%. The counter closed marginally higher at Rs. 225.00.

ASI lost 23.10 points (0.39%) to close at 5,855.09 and the S&P SL20 index gained 4.07 points (0.13%) to close at 3,194.72. Turnover was Rs. 759.6Mn.

On Tuesday, retail profit taking persisted whilst foreign picked up blocks in few blue-chips. A general feeling of retail selling was seen today although this is seen as a correction as foreigners still value our blue-chips whilst reduction in interest rates are also expected in the future. Sampath Bank, LOLC and John Keells Holdings were the top picks for the foreigners today.

ASI dropped 54.24 points (0.93%) to close at 5,800.75 and the S&P SL20 index lost 8.96 points (0.28%) to close at 3,185.76. Turnover was Rs. 1,351.0Mn.

Indices closed higher on Wednesday helped by gains on John Keells Holdings, Commercial Bank and Nestle. The former two counters and LOLC saw tremendous institutional interest with Commercial Bank being the pick of the day. Retail activity still remains on the sideline which is seen as a period of consolidation. Yields on all three treasury bills fell further in today’s auction.

ASI gained 25.15 points (0.43%) to close at 5,825.90 and the S&P SL20 index gained 7.87 points (0.25%) to close at 3,193.63. Turnover was Rs. 2,678.7Mn.

Thursday, Commercial Bank and John Keells Holdings continued attract institutional and high net worth investors with the two counters dominating today’s turnover. Retail investors seem to have settled down awaiting another bullish period. Foreign investors exiting certain companies shouldn’t be seen as a worrying issues as these shares are trading at attractive prices and local buying helps to retain future gains.

ASI dipped marginally by 9.01 points (0.15%) to close at 5,816.89 and the S&P SL20 index gained 3.98 points (0.12%) to close at 3,197.16. Turnover was Rs. 3,425.1Mn.On Friday, premier blue-chip John Keells Holdings and Commercial Bank continued to attract foreign and local institutional activity. John Keells ended up being the highest contributor to turnover. Retail activity remained dull today.ASI lost 17.20 points (0.30%) to close at 5,799.69 and the S&P SL20 index lost marginally by 0.80 points (0.03%) to close at 3,196.81. Turnover was Rs. 951.1Mn.

Top contributors to turnover were John Keells Holdings with Rs. 591.0, Commercial Bank with Rs. 177.9Mn and CT Holdings with Rs. 31.8Mn. Most active counters for the day were Union Bank, Commercial Bank and John Keells Holdings.Notable gainers for the day were CT Holdings up by 8.9% to close at Rs. 144.00, Browns Investments up by 5.9% to close at Rs. 3.60 and Browns Beach Hotel up by 5.8% to close at Rs. 20.00.. Notable losers for the day were Singer Sri Lanka down by 6.2% to close at Rs. 100.10, Renuka City Hotels down by 6.0% to close at Rs. 235.00 and Hotel Services down by 2.9% to close at Rs. 16.50.Cash map for today was 60.86%. Foreign participation was 47% of total market turnover whilst net foreign buying was Rs. 446Mn.

http://www.nation.lk/edition/business/item/15332-weekly-market-focus.html

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

The Bourse Weekly Performance Sun Feb 03, 2013 5:39 am

The Bourse Weekly Performance Sun Feb 03, 2013 5:39 am

Weekly Market Focus Mon Feb 04, 2013 4:12 pm

Weekly Market Focus Mon Feb 04, 2013 4:12 pm