One of the most common questions investors ask is whether to invest in fixed deposits or invest in stocks.

The investors tend to ask why they have to invest in risky equities which do not guarantee a return when they feel they can get considerably high return investing in high yielding fixed deposits as interest rates are comparatively on the higher side. But on the other hand there are investors who believe that equities give much high return than fixed deposits and they put most of their hard earned savings in stock market.

The above behavioural pattern reflects misconceptions possessed by the investors who tend to look at the two investment vehicles in a mutually exclusive manner. In other words they tend to compare fixed deposits and stocks to invest only in one asset class. But in reality you are not comparing “apples to apples” when you compare fixed deposits with equity investments. Fixed deposits and stocks are two different asset classes with different investment characteristics, where both of them could be utilised to give you maximum return on investments. In summary what an investor should consider mainly is how to allocate investments into fixed deposits and stocks, in contrast to conventional way of trying choose between fixed deposits and equities.

To understand how much money an investor needs to allocate for each asset class, let’s first look at some of the common questions to understand the investment characteristics of the two asset classes.

Do stock market investments actually give higher return than fixed deposits?

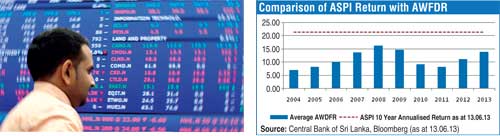

When we talk about stock market investments in Sri Lanka we are talking about one of the best performing stock markets in the world during the last decade. The Colombo Stock Exchange has given annualised returns of 21.3% for the last 10 years, which is much more than any other investments including fixed deposits have given for the same period. So yes, it gives considerably high returns.

But then if you ask a layman how he or she thinks of investing in the stock market, the general perspective is that the stock market is a place where people have lost their hard earned money. This sentiment was a result of a market correction that took place in 2011 and which continued till mid 2012. The correction is a term used by stock market analysts to define behaviour of a market where a market takes a break from a rapid rally and moves in the opposition direction temporarily. This phenomenon took place at the Colombo Stock Exchange after the stock market gained more than 100% for two consecutive years after the end of the war.

Even though the stock market has gained by more than 100% for two years, and lost only about 20% since it hit peak in February 2011, an average person in Sri Lanka sees it as a place where people lost more money than they gained. A layman to stock market investing would think “why is that?” as people technically should have made more money than gained. The answer lies in the investors’ investment/trading pattern that has resulted in losing much more money than they have gained.

One of the reasons for the losses is the late entry into a bull market. But that is only a part of the story as most of the investors who made losses have actually participated in the bull rally in 2009 and 2010, but subsequently lost the money. The main reason is as we discuss in the next paragraph is the individuals’ tendency to look for short term profit by trading in the market.

If it was possible for you to invest in All Share Price Index (ASPI) and hold it for five years, during last 10 years you would have never recorded a loss. In other words if you held on for your investment in the Colombo Stock Exchange for at least five years in any date you have invested in from 2003 to 2013 it is not possible for you to lose the money on the ASPI. This reflects a basic characteristic of equity investments.

Equity investments yield best investment characteristics when you invest for the long term. But if you try to beat the market by trying to buy the shares and sell the shares, trying to predict the share prices’ high and low, it will be incredibly difficult task (almost impossible task) to profit from the market for a general investor as there is considerably high psychological risk premium in short term trading. If you plan to trade short term you will need to have psychological attributes and disciplines on top of well formulated strategy to reduce the additional psychological risk premium to benefit from the market.

So coming back to the question whether stock markets give higher returns compared to FDs, it really is as annualised return of 21% for 10 years considerably high than the FD returns for the corresponding period.

How difficult is for a novice investor to select the right stocks to invest in?

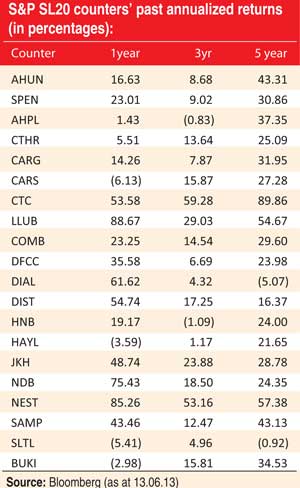

Stock selection can be considerably difficult task to master if you are looking to continuously beat the return of market (ASPI), but there is plenty of research available for an investor to make an informed decision. However to make above average return is not that difficult, if an investor has the patience to hold on to investments. For comparison if we just take SL’s S&P 20 shares and check how the companies have performed, most of the counters have performed exceptionally well for varying time horizons.

How risky are stock market investments?

As we have discussed, there is considerable risk in investing in the Colombo Stock Exchange. Equity investments in stock markets do not give guaranteed returns as fixed deposits and the prices of the shares can be quite volatile. One of the reasons why an investor needs to hold on to stock market investments for long term is to not to be a captive of short term fluctuations of the prices. In the medium to long term (more than five years time horizon) stock market has given stable high positive returns as volatilities adjust over time.

Since stock market investments are risky investments, the investor need to give due care in investing in stocks. Investor should use proper risk management techniques to reduce high exposure to volatilities. Some of the techniques an investor can use are investing in fundamentally sound shares with less down side risk, take a portfolio view and invest only portion of his funds in equity and diversify his equity investments in to several counters.

Are FDs risk-free investments?

Risks of fixed deposits are considerably low, especially in terms bank deposits of which up to Rs. 200,000 are insured by Sri Lanka Deposit Insurance Scheme. But when you take high-yielding fixed deposits on non-banking finance institutes (NBFI) there may be credit risk component as weak credit profile of the finance companies poses a risk. Therefore fixed deposits are not risk free instruments, but the risk of losing the capital investment can be minimal.

What is the role of inflation in choosing investments?

Sri Lanka, a country traditionally known to have high inflationary environment, inflation plays a significant role in deciding on investments. If we look at the history, equity has been a very strong hedge against the inflation providing returns exceeding inflation comfortably. But in terms of fixed deposits, historically they have been a poor hedge against the inflation as fixed deposits have failed to give clear returns excess of inflation.

How should an investor approach investing in fixed deposits and stocks?

As we discussed before an investor should look into allocating funds to both risky equity investments and secure fixed deposits. To understand the allocation between two asset classes, investors should understand each other’s risk and return profiles. Equities are risky investments, which can result in considerably high return over the long term exceeding inflation but short term price fluctuations can result in the investor making losses. Fixed deposits give moderate returns with guaranteed interest receipts, and there is virtually close to no risk in losing the capital, especially in terms of deposits in banks.

The asset allocation will basically depend on ability to take risk and willingness for an investor on taking the risks. There are myriad factors to consider in deciding an investor’s ability to take risk such her age, education level, profession (what percentage of income is variable), income level, wealth, etc. Basically if you have higher capacity to take the risk you should invest in high return risky assets such as equity. But if you have low risk absorbing capacity with many monetary obligations, you should look to allocate your funds for more secured investments such as fixed deposits. A rule of thumb in allocating funds according to your age is to subtract your age from 90, and invest in equity (risky) assets on the deriving number’s percentage. Say for example, if you are 40 years old, then it is prudent for you to allocate (90-40) 50% of investments to equity. The presumption here is a young investor would have less obligations and high human capital (future earning potential), compared to an older investor. But it can be much more complicated than that and the investor should consult an investment advisor in deciding the perfect investment mix for him.

http://www.ft.lk/2013/07/05/selecting-between-stock-market-investments-and-fixed-deposits/

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home