npp wrote:Good initiative. I did not give it a complete read but judging but seems a great effort. I'll be back to read this but on first impression I'm not getting the clear picture.

Jiggy has explained much. Also as mentioned in some comments, future cash flows too depend on a lot of assumptions. Good if you can note down some of yours if possible with others' who are following can contribute

Thanks all!!

Great ideas are coming up from everyone here. That's very encouraging.

As you may have noticed, this topic was started accidentally and well before intended times. So it lacks my usual preamble to explain what I am talking about. Anyway, let me try to clarify a little.

I've been using (my own) different means to get an idea about the value of a share for sometime.

In the recent past, with the help of some of members, a formula was developed.

http://forum.srilankaequity.com/t29902-my-share-valuation-formula

The result was helpful. But there were limitations.

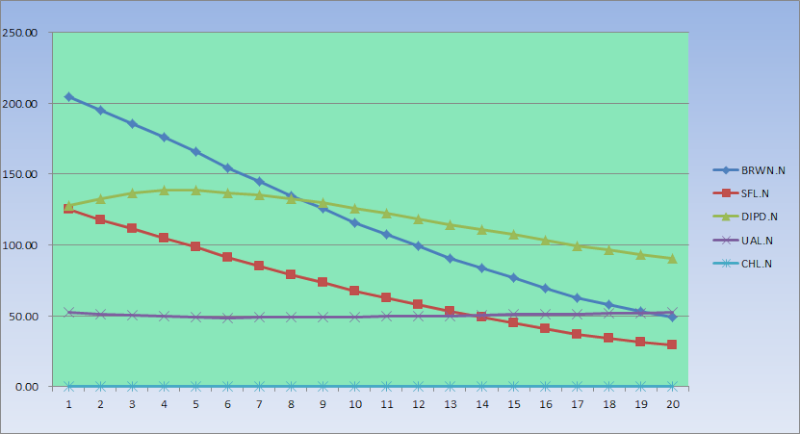

As in the case with usual DCF methods, When we calculate the present value for different projected years, the final result may differ. For example, a share may look good when 5 years are used but may look bad for 10 year projection. Then a question is coming should we use 5 years or should we use 10 years; and why?

To eliminate that confusion, I decided to find a method to give a 'snap shot' view of multiple (year) period projection. That's the reason behind initiating this tool.

For the time being, as inputs, I have used only published numbers; NAV, EPS and DPS. So the automatic assumption is, the current trend in earnings and dividends will continue in to the future. (I know that's contrary to the basis of usual DCF methods).

The discount rate used is 12%.

I have taken EPS instead of FCF; so another automatic assumption is, the remaining cash after paying divided is considered as capital expenditure. (This is also arguable).

ALSO:

Few words about how I intend to used this tool......

Right now, I remain as a medium term 'trader', therefore, I need not and do not intend to use this to judge or predict any future market price. (For that, I consider technical analysis).

But there will be many uses of this tool such as, to identify the shares with a higher chance of a price appreciation; to judge if a market price is justifiable by its value; to avoid very 'expensive' shares; and to see if a share worth averaging etc.

Another accident use I noticed was there are common characteristic of 'overvalued-high demand' shares (NEST, CTC etc).

Finally, I do not know 'DCF projection' is a good name for this tool. May be I need to think of a better name later.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home