Amana Bank for new wave of growth with IPO

Amana Bank entered the financial services sector in 2011 as the pioneering Islamic bank promoting an alternative method of financing.

Flaunting its unique value proposition, since inception the bank has been determined to be the leader in the Islamic finance sphere and has ensured that it maintains this status.

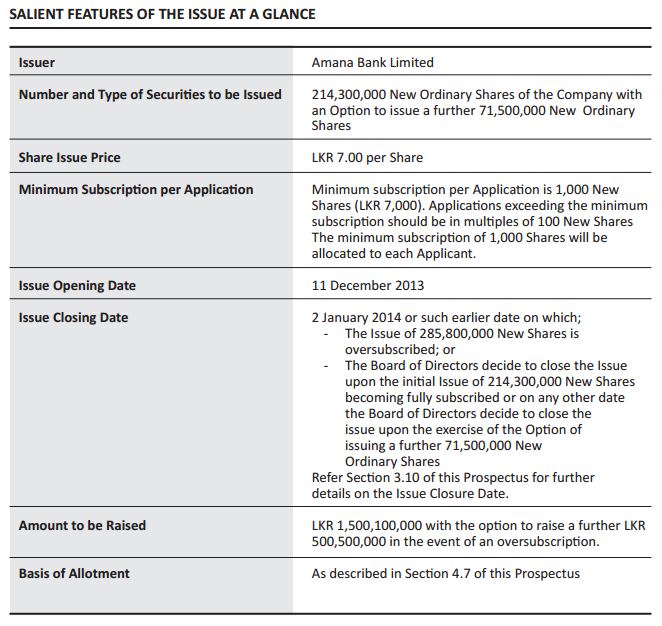

Amana Bank’s hunger for growth has pushed the institution implement a number of measures to ensure its efforts are geared towards the direction of its expansion. The most recent announcement by the bank in this regard is the Initial Public Offering (IPO) that will be opened on 11 December 2013.

Amana Bank Managing Director/CEO Faizal Salieh shared with the Daily FT the relevance and the timing of the IPO while highlighting the growth and stability of the bank along with its future outlook.

Following are excerpts:

By Shabiya Ali Ahlam

Q: Tell me how has the bank progressed since its commencement?

A: Amana Bank was launched in August 2011. Prior to the launch, we were focused on raising the minimum regulatory capital required by Central Bank in order to license a bank. This was particularly challenging as it was during the period when the battle with the LTTE was at its peak and the country’s risk rating was below the investment grade.

Against many odds we negotiated with the foreign investors and convinced them to invest in the country and the bank. Raising the required capital under these circumstances was a tremendous achievement for the bank, one which gave the market a lot of confidence and assurance in this new model of banking.

We were able to attract foreign investors such as the Islamic Development Bank (IDB) of Saudi Arabia, Bank Islam Malaysia and AB Bank of Bangladesh. While IDB, a AAA rated development finance institution owned by several governments, has a policy of investing only in its member country; for Amana Bank it made an exception. It changed its policy, and decided to invest in a Muslim minority nation such as Sri Lanka. The fact that Sri Lanka was going to form the first Islamic bank was an indicator of good minority relations in the country for IDB.

The Central Bank of Sri Lanka (CBSL) licensing a Sharia-compliant bank further encouraged this institution to set foot to Sri Lanka. This was a pivotal step not just for Amana Bank but for Sri Lanka as an investment destination.

Since August 2011, the bank has grown from strength to strength. Even though we had a slowdown in growth in 2012 due to the 18% credit ceiling imposed by the CBSL, this year we have regained our momentum and are keeping up with the pace.

Q: Could you shed some light on the recent performance of the bank?

A: When comparing the first nine months performance in 2013 with the entire financial year of 2012, our performance is impressive. In 2012 our deposits stood at Rs. 13 billion whereas within nine months of 2013 the bank has increased this base by about 27%. In terms of credit growth in the same period, the customer financing portfolio increased to over Rs. 11 billion, a 57% growth from 2012. This increase in performance shows that we have re-gained momentum and confirms that our unique business model is being accepted by all communities in the country.

We have 24 strategically located branches island wide of which 10 branches were opened during 2013. Therefore, it could be said that we have a reasonable network of customer service points. Our plan is to increase our reach and convenience as we move forward and to touch the lives of many Sri Lankans as possible.

Q: How stable is your customer base?

A: Looking at our customer base, we have over 100,000 customers to date. We have about 3,600 large depositors and about 104,000 small depositors. This diversity gives an indication that the portfolio is not concentrated towards a particular segment and that the deposit base is stable. This stability is an important element for a bank. In terms of the deposits mix, the bank has about 55% in CASA balances (Current Account and Savings Account), and 46% in term deposits. That in my view is a good balance.

Q: How diverse is the product portfolio of the bank?

A: We have come a long way in this regard. When we launched the bank in 2011 we had of 11 products. That is, five consumer banking products and six business banking products. Today we have a total of 38 products in our portfolio where we are offering 16 consumer banking products, 19 business banking products, and three treasury products to the market.

We have a dedicated product development team which is constantly working on new products to cater to the requirements of our customers. We will be introducing a Sharia-compliant pawning product to our customers shortly, and Amana will be the first player in the local Islamic finance industry to introduce such an instrument.

Q: Who are the strategic partners involved in setting up the bank?

A: Five strategic shareholders infused capital at the time of setting up the bank, three of which are international banking giants, namely, Bank Islam Malaysia, AB Bank and Islamic Development Bank. These three institutions are the pillars to our shareholder base and provide strategic inputs and technical support for the bank’s operations.

Why did they invest? Primarily because they were confident in the operation and performance of Amana and they identified the potential for Islamic banking in Sri Lanka. We are probably the only bank in Sri Lanka that has three international banking institutions as shareholders with significant stakes of ownership.

Q: Being in operation for nearly three years where does the bank stand today?

A: Clearly we have created a footprint in the banking sector as we have a unique banking model. It is unique because it is based on the profit and loss sharing system and is a viable alternative for the traditional model.

People now have a choice of banking differently. They are now aware that there is another method of banking that is fair and equitable, simply because it follows a profit sharing model instead of a fixed interest model. This is the value proposition Amana has brought to the market. However I must stress that Amana is not a bank for faith-based transactions or faith-based individuals. In our customer base we have a growing number of non-Muslims. When it is about a transaction, we treat all our customers the same way, we don’t differentiate. We are not a faith-based bank, but we are a bank with a unique value proposition.

Q: How has the bank’s growth been in comparison to the industry growth rates?

A: Deposit growth in the overall banking sector in the nine month period has been around 16% and the credit growth moderated and declined to about 5%. In this background, the bank posted a 27% growth in deposits and a 57% growth in credit. Total asset growth in the sector was about 18% and the bank’s asset growth was about 26%.

Q: How has Amana contributed to the Islamic banking industry?

A: The name ‘Amana’ is positioned in the market as the pioneer in Islamic banking and insurance. It pioneered Islamic finance in its full form. It was Amana that introduced the first awareness of Islamic finance to Sri Lanka. The product and methodologies it introduced has enabled the growth of the industry by other windows following the footprints the bank has left. Other institutions have always walked behind us. I can confidently say that Amana has been trailblazing the development of Islamic finance industry. Furthermore, it is our tiring efforts, lobbying, and dialogue with the regulators that led to the creation of supportive legislation for the industry.

Amana is also playing a lead role in the Islamic Banking Committee established by the Sri Lanka Banks Association (SLBA) with myself as its Chairperson. This dedicated committee looks at the issues and challenges faced by banks in this field, and put them across to the regulators and other relevant institutions. This committee has representations from the heads of all banks offering Islamic banking products. In addition to that, we have two representatives from the CBSL. While this demonstrates the close relationship with the regulators, the objective of the committee is to deliberate issues prevailing in this sphere and to ensure uniformity and consistence is maintained in documentation and processes.

Q: What improvements have the committee brought to the Islamic finance sphere?

A: It was due to the efforts of this committee that the President made a policy statement in the 2011 Budget that Islamic finance must have a level playing field with the conventional banking system. The purpose of this policy is to ensure that an Islamic finance transaction does not become more costly to the customer by having taxes that are not applied to conventional banking transactions. Although the policy is to bring tax neutrality between the conventional and Islamic banking system, it is yet to be implemented by the Inland Revenue. We are also attempting to bring in a greater degree of uniformity and harmonisation in the application of Sharia decisions.

One of the most recent efforts of the committee is to enable an alternative instrument to the Treasury bill and bond. Islamic finance institutions currently are unable to offer such products since they are interest-based. Making available such an instrument will help the industry manage its liquidity surpluses and also offer the public an alternative gilt-edged instrument for investment. Therefore for this purpose we are looking at an alternative instrument.

Q: Amana Bank recently got the green light by the SEC to be listed on the CSE. How important strategically is the announcement of the IPO and its timing?

A: We are at a stage of our development where we have to raise funds for two main purposes and list the bank’s shares on the bourse. One is to meet the minimum capital requirements set by the CBSL for all banks by 2013 and again by 2015. The second purpose of raising funds is to support the growth and expansion of the bank.

There is good potential for growth of Islamic banking in this country. The economy is poised to grow at over 7% per annum and the Government has a clear strategy in place to take the country forward. In the journey towards a $ 4,000 per capita GDP by 2016, with the post-conflict opportunities in the north and east and other potential improvements, the bank has a role to play by getting involved in it. We want our shareholders and customers to benefit from these opportunities. We want the public to participate in this growth through us by being a shareowner of the bank.

Q: Why do you think the public should invest in Amana Bank?

A: The bank has a unique model which is based on a profit and loss sharing system that is clearly seen as fair and equitable. We want the public to be shareowners as opposed to being shareholders. We want our investors to feel they own a part of the bank regardless of the size of their investment. Secondly, we are the only Sharia-compliant bank in Sri Lanka and our IPO gives the public an opportunity to invest in this sector.

Another point is that, shares in the banking sector have always performed well. Therefore, here is an opportunity for people to be part of the growth of Amana as well as the banking sector.

It is also noteworthy to mention that globally the Islamic finance industry is growing at an average of 15-20% a year. Countries such as the UK have realised the potential of the industry and have made substantial and relevant changes to their regulatory policies and legislative framework.

Q: The bank hopes to raise Rs. 1.5 billion. How much do you estimate the IPO to actually raise?

A: Our Board is optimistic because we have a unique model that is fast gaining acceptance in the country. This IPO is for investors who really want to buy our share and be benefitted in the medium term. If someone intends on punting with the IPO, we are not the bank for such people. With punting, we feel that a customer does not become a shareowner.

Q: On what basis was the Rs. 7 per share arrived at? Who valued it?

A: Valued by KPMG, the share per price of Rs. 7 was arrived using a discounted cash flow basis.

Q: What is the net asset per share of Amana as of today?

A: Today it stands at Rs. 3.50. What is important is to look at the price to book value, which is comparable with the bigger Islamic banks in the region.

Q: Will the following of an alternative banking model have an impact on the way the IPO will be raised?

A: The way in which the IPO will be raised remains the same. There is no exception made. We are following all the requirements laid down by the SEC and CSE.

Q: What is the relevant stake/ownership held in Amana? Could you give me a breakdown?

A: Among the overseas investors we have Bank Islam holding about 18%, AB Bank 18%, and IDB 12%. Among local investors we have Akbar Brothers at about 12% and Expolanka Holdings at about 9%. All of these holdings have been approved by the regulator in the context of the IPO. The strategic shareholders subscribed to a recent Rights Issue at the same price of Rs. 7 per share as is the IPO Price.

Q: How many shareholders are reducing their stake, if so by what percentage?

A: It is only Bank Islam that is expected to dilute because of an existing condition to the banking licence. At the initial stages they were allowed to hold 20% and reduce it to 15% over a time period.

Q: At what price did these institutions originally subscribe to Amana shares?

A: They initially subscribed at Rs. 5 per share in 2010. That was prior to the bank opening for business. In the recent Rights Issue, the shareholders subscribed to the shares at Rs. 7 per share which is the same price as the present IPO.

Q: When did Amana begin paying dividends and how much has it paid so far?

A: The bank is new and still young to pay dividends. We are on course to break-even in 2014 and our business has the potential to grow and give returns in due course.

Q: Where is the bank heading in terms of its future outlook?

A: The bank has a good governance structure. And it has good risk management policies, processes and procedures. The frameworks for these were in place since the bank was launched. We had external consultants advising us on the best practices. We have a good framework on risk management practices and have brought in relevant policies and procedures to manage risk across the bank.

We also have an active Board Integrated Risk Management Committee and Audit Committees that are actively and vigorously involved in ensuring the bank’s internal risk management system and internal control environment is comparable to industry standards. This gives confidence to our investors. Being a new bank we have particularly taken care of these areas. Moreover, the Amana operates on the ‘Hub and Spoke’ model which modern banks work on. When we set up the bank we started on this model.

Islamic banking is not rocket science, it could be easily understood and practiced by anyone with an ability to grasp its core principles and value proposition. One doesn’t have to be a Muslim to be good at it. It is all about the principles, the method, the system, understanding the value proposition and the operating model to pick it up. As long as people understand these aspects, anyone can work in the bank. In fact we have a number of people who come from various communities working in the bank and demonstrating excellent skills. We are building good talent in this area. The industry would need more of them as it develops and grows beyond the present level. We are a bank for all when it comes to customers, market and employees.

http://www.ft.lk/2013/12/05/amana-bank-for-new-wave-of-growth-with-ipo/

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home