http://www.cse.lk/cmt/upload_cse_announcements/1901384855239_.pdf

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Encyclopedia of Latest news, reviews, discussions and analysis of stock market and investment opportunities in Sri Lanka

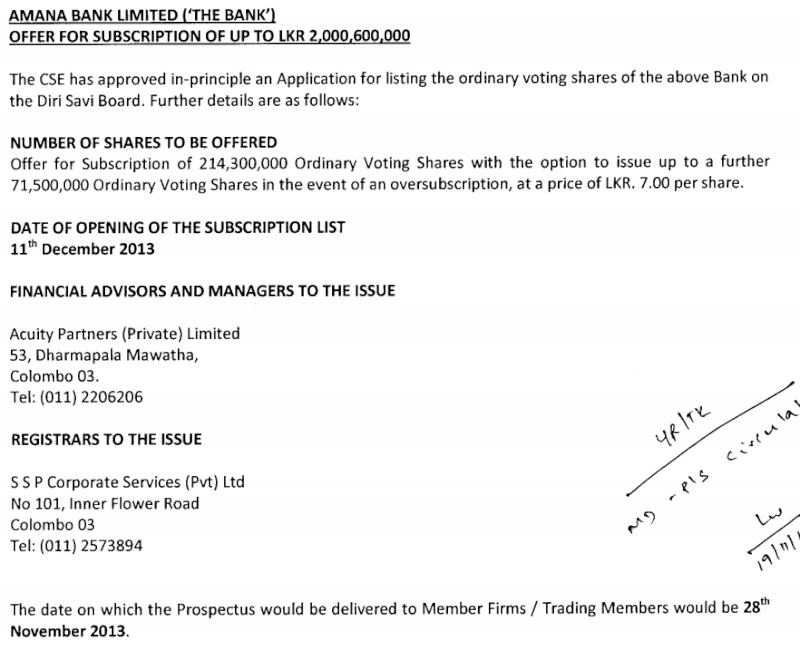

19-Nov-2013 Amana Bank - Offer for Subscription Tue Nov 19, 2013 4:01 pm

19-Nov-2013 Amana Bank - Offer for Subscription Tue Nov 19, 2013 4:01 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Tue Nov 19, 2013 5:37 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Tue Nov 19, 2013 5:37 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 20, 2013 2:06 am

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 20, 2013 2:06 am

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 20, 2013 8:21 am

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 20, 2013 8:21 am

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 20, 2013 9:24 am

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 20, 2013 9:24 am

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 20, 2013 12:50 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 20, 2013 12:50 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 20, 2013 5:09 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 20, 2013 5:09 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 20, 2013 9:57 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 20, 2013 9:57 pm

Friend its ur first post, if you don't mind are u in anyway connected to the bank?realman wrote:hi

I heard about Amana bank is asset based attractive valuation and it is fully fledged shariah based Bank .

Re: Amãna Bank goes for IPO and listing on the Bourse Mon Nov 25, 2013 5:55 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Mon Nov 25, 2013 5:55 pm Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 2:22 am

Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 2:22 am

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 1:02 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 1:02 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 1:13 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 1:13 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 5:01 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 5:01 pm

For the last 2 years, not even a one handful of IPOs gave a first day gains to retailers. All others failed despite their prospectus. And one, PCH is on the verge of bankruptcy..hariesha wrote:If successful, will help to draw the retailers back. In the past with every IPO considerable no of retailers joined CSE.

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 5:32 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 5:32 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 5:51 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 5:51 pm

Even I couldn't get through. Since their whole business is based on the diyabariya law maybe only some peeples are allowed to download the report?Chinwi wrote:Can you get these annual reports ?

For me , it says Forbidden .

http://www.amanabank.lk/index.php/en/amana-bank/annual-report

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 6:15 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 6:15 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 7:30 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 7:30 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 8:09 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 8:09 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 8:41 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 8:41 pm

Dear Jiggy... u will never learn i guess.... maybe u shud tell everyone y u have sooo much hatred towards muslims and islam.... about ur research on anti islamic sites coz.... ur ex girl friend... errrm who happens to be muslim dumping u.... and u errrrrrmmm........ maybe i shud stop now....Jiggysaurus wrote:This cannot be categorized as a bank, it is more of seetu scheme catering to a specific (whatever) following a (whatever) law.

The CBSL will need to answer why this is being allowed to publicly list. This is a seetu scheme/finance company following an ancient stone age law and catering to a specific (whatever).

Anybody promoting this will need to answer some questions

1) Why is the chairman starting his statement with a religious (whatever) mantharey? Not even BFL or PCH does this in their annual report.

2) Why is a seetu scheme following an ancient barbaric law allowed to raise money from peeple who don't have any knowledge or know the dangers of this law?

3) The employment in this "bank" seems to be based on racism. More than 90% of the directors and senior management are from a specific (whatever). How many Sinhalese and Tamils are employed in this so called bank?

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 9:14 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 9:14 pm

I'm discussing an IPO that is coming on to the share market.Zaiban wrote:

please don't use ur personal agendas and ruin this forum.... please admins... moderators.... u shud stop such jokers on this forum... as this is not a forum for racial hatred... but to discuss the share market....

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 9:17 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 9:17 pm

The above figures are almost one year back. Probably now they have better ratios, unless they have gone for a share split after 31st Dec. 2012. If NAV has improved to around Rs.5/- offer price of Rs.7/- is reasonable.Gaudente wrote:according to the linked 2012 AR they have 0.16 EPS and BV of 3.40 rupees. Only an idiot could pay 7 rupees for such crap

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 9:26 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 9:26 pm

Sorry mate, couldn't find any Sinhalese or Tamil in the shareholder list. But there are some hybrid varieties in the shareholder list.Jiggysaurus wrote:This cannot be categorized as a bank, it is more of seetu scheme catering to a specific (whatever) following a (whatever) law.

The CBSL will need to answer why this is being allowed to publicly list. This is a seetu scheme/finance company following an ancient stone age law and catering to a specific (whatever).

Anybody promoting this will need to answer some questions

1) Why is the chairman starting his statement with a religious (whatever) mantharey? Not even BFL or PCH does this in their annual report.

2) Why is a seetu scheme following an ancient barbaric law allowed to raise money from peeple who don't have any knowledge or know the dangers of this law?

3) The employment in this "bank" seems to be based on racism. More than 90% of the directors and senior management are from a specific (whatever). How many Sinhalese and Tamils are employed in this so called bank?

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 9:34 pm

Re: Amãna Bank goes for IPO and listing on the Bourse Wed Nov 27, 2013 9:34 pm

Further their last rights issue also at Rs.7/-. So after eight months issuing shares at the same price is reasonable providing things not deteriorated in between.hariesha wrote:The above figures are almost one year back. Probably now they have better ratios, unless they have gone for a share split after 31st Dec. 2012. If NAV has improved to around Rs.5/- offer price of Rs.7/- is reasonable.Gaudente wrote:according to the linked 2012 AR they have 0.16 EPS and BV of 3.40 rupees. Only an idiot could pay 7 rupees for such crap

Re: Amãna Bank goes for IPO and listing on the Bourse Thu Nov 28, 2013 2:26 am

Re: Amãna Bank goes for IPO and listing on the Bourse Thu Nov 28, 2013 2:26 am

Re: Amãna Bank goes for IPO and listing on the Bourse Thu Nov 28, 2013 6:57 am

Re: Amãna Bank goes for IPO and listing on the Bourse Thu Nov 28, 2013 6:57 am

I doubt a serious increase in EPS is there for the current year..hariesha wrote:The above figures are almost one year back. Probably now they have better ratios, unless they have gone for a share split after 31st Dec. 2012. If NAV has improved to around Rs.5/- offer price of Rs.7/- is reasonable.Gaudente wrote:according to the linked 2012 AR they have 0.16 EPS and BV of 3.40 rupees. Only an idiot could pay 7 rupees for such crap

Similar topics

Permissions in this forum:

You cannot reply to topics in this forum