Last edited by Quibit on Mon Feb 02, 2015 1:58 pm; edited 1 time in total

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Encyclopedia of Latest news, reviews, discussions and analysis of stock market and investment opportunities in Sri Lanka

Count Down to 6000! Mon Feb 02, 2015 10:16 am

Count Down to 6000! Mon Feb 02, 2015 10:16 am

Last edited by Quibit on Mon Feb 02, 2015 1:58 pm; edited 1 time in total

Re: Count Down to 6000! Mon Feb 02, 2015 10:22 am

Re: Count Down to 6000! Mon Feb 02, 2015 10:22 am

Re: Count Down to 6000! Mon Feb 02, 2015 10:23 am

Re: Count Down to 6000! Mon Feb 02, 2015 10:23 am

Re: Count Down to 6000! Mon Feb 02, 2015 10:43 am

Re: Count Down to 6000! Mon Feb 02, 2015 10:43 am

Re: Count Down to 6000! Mon Feb 02, 2015 10:53 am

Re: Count Down to 6000! Mon Feb 02, 2015 10:53 am

VALUEPICK wrote:These types of sell off will be there in almost all types of market due to different reasons at different times. In a bull market these types of thing create opportunities. If it is bear market we should avoid stocks. Even in India not only their stocks but also their rupee had some of the biggest sell off and later recovered strongly. We should not touch some blue chip stocks until we find their base. On the other hand there are plenty of attractive small and mid caps stocks in the market now. Market volatility, pause, sell off and correction create opportunity for mid and long players. Defensive sector is one of the best bet in the market. A Defensive or non Cyclical stock is a stock whose profit growth and therefore its price has a very low correlation to the market activity. No matter how the economy/market is doing, the revenues, the earnings and the cash flows of the company remain relatively stable and so the share price. Consumer staples such as food and beverages, Health care, household and Personal Care stocks are known as Defensive. Besides current major uptrend is about to reach third and final stages. In final stages above sectors should outperform others. It is time to rotate stocks and identity new future winning stocks.

If we analyse policy decisions, both governments have given priority to agriculture/farming/food, plantation and export sector. In addition unlike in the past there is no threat to tourism sector either. More tourists in the future mean more demand for transportation, food and leisure activities. Companies in these areas should have growth irrespective short term issues.

Re: Count Down to 6000! Mon Feb 02, 2015 10:55 am

Re: Count Down to 6000! Mon Feb 02, 2015 10:55 am

Re: Count Down to 6000! Mon Feb 02, 2015 11:40 am

Re: Count Down to 6000! Mon Feb 02, 2015 11:40 am

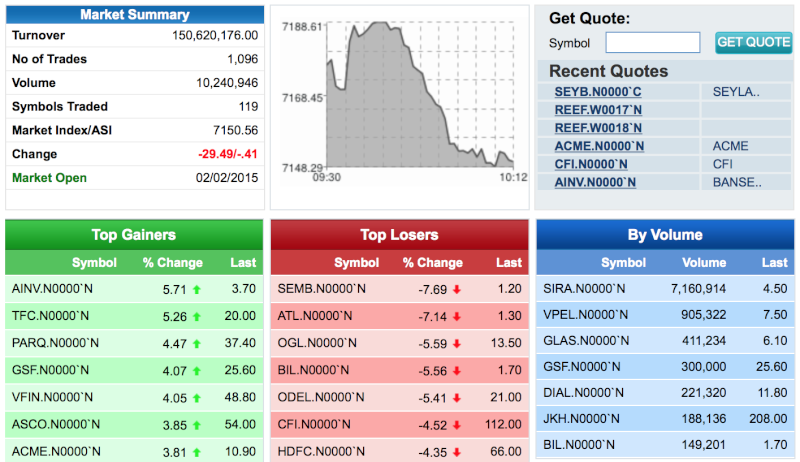

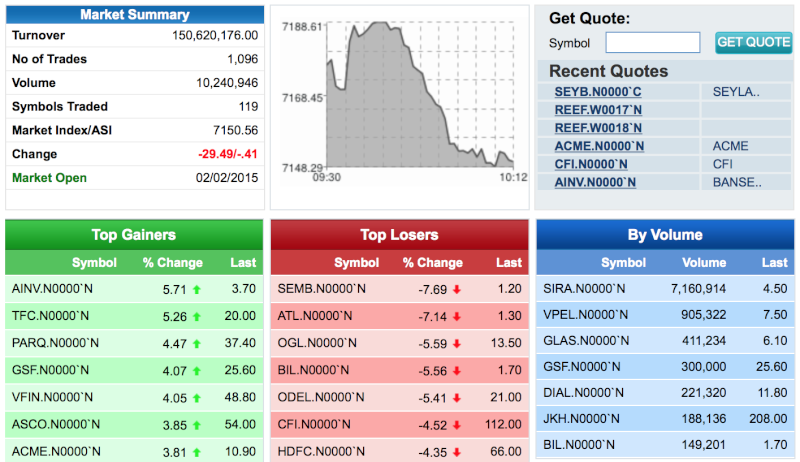

EquityChamp wrote:I advised about this drop early hence it is anticipated. What need to be looked at to find the bottom of this decline. My estimation is 6900-7000. A good point to enter.

Re: Count Down to 6000! Mon Feb 02, 2015 11:50 am

Re: Count Down to 6000! Mon Feb 02, 2015 11:50 am

Senior Citizen wrote:VALUEPICK wrote:These types of sell off will be there in almost all types of market due to different reasons at different times. In a bull market these types of thing create opportunities. If it is bear market we should avoid stocks. Even in India not only their stocks but also their rupee had some of the biggest sell off and later recovered strongly. We should not touch some blue chip stocks until we find their base. On the other hand there are plenty of attractive small and mid caps stocks in the market now. Market volatility, pause, sell off and correction create opportunity for mid and long players. Defensive sector is one of the best bet in the market. A Defensive or non Cyclical stock is a stock whose profit growth and therefore its price has a very low correlation to the market activity. No matter how the economy/market is doing, the revenues, the earnings and the cash flows of the company remain relatively stable and so the share price. Consumer staples such as food and beverages, Health care, household and Personal Care stocks are known as Defensive. Besides current major uptrend is about to reach third and final stages. In final stages above sectors should outperform others. It is time to rotate stocks and identity new future winning stocks.

If we analyse policy decisions, both governments have given priority to agriculture/farming/food, plantation and export sector. In addition unlike in the past there is no threat to tourism sector either. More tourists in the future mean more demand for transportation, food and leisure activities. Companies in these areas should have growth irrespective short term issues.

Agree with you. Also there is a maximum crap that will be taken by the big time players in the market.

Especially FMCG companies are price sensitive and have to react quickly to the demand and price points. Pushing cost of goods higher and reducing margins will not be sustainable for long periods and it affects volumes and profitability.

you will soon see the Blue Chip shares tumbling suddenly and regaining that once lost market confidence will be long drawn.

Re: Count Down to 6000! Mon Feb 02, 2015 11:51 am

Re: Count Down to 6000! Mon Feb 02, 2015 11:51 am

Re: Count Down to 6000! Mon Feb 02, 2015 11:56 am

Re: Count Down to 6000! Mon Feb 02, 2015 11:56 am

Re: Count Down to 6000! Mon Feb 02, 2015 11:57 am

Re: Count Down to 6000! Mon Feb 02, 2015 11:57 am

Re: Count Down to 6000! Mon Feb 02, 2015 12:10 pm

Re: Count Down to 6000! Mon Feb 02, 2015 12:10 pm

Quibit wrote:I believe benefits derived by the people from the budget would increase demand for food items. What is the most favourite food item in good time!

I guess its CHICKEN!!

Anyone got the valuations of the related companies?

Re: Count Down to 6000! Mon Feb 02, 2015 12:33 pm

Re: Count Down to 6000! Mon Feb 02, 2015 12:33 pm

Re: Count Down to 6000! Mon Feb 02, 2015 12:40 pm

Re: Count Down to 6000! Mon Feb 02, 2015 12:40 pm

Re: Count Down to 6000! Mon Feb 02, 2015 12:46 pm

Re: Count Down to 6000! Mon Feb 02, 2015 12:46 pm

Re: Count Down to 6000! Mon Feb 02, 2015 12:47 pm

Re: Count Down to 6000! Mon Feb 02, 2015 12:47 pm

EquityChamp wrote:By the trend market is going today it is said to hit 7000 level which is the resistance level. Market is in a over-sold region now. Lot of shares are available at bargain prices.

Re: Count Down to 6000! Mon Feb 02, 2015 1:58 pm

Re: Count Down to 6000! Mon Feb 02, 2015 1:58 pm

Last edited by Quibit on Mon Feb 02, 2015 2:03 pm; edited 1 time in total

Re: Count Down to 6000! Mon Feb 02, 2015 2:03 pm

Re: Count Down to 6000! Mon Feb 02, 2015 2:03 pm

Re: Count Down to 6000! Mon Feb 02, 2015 2:12 pm

Re: Count Down to 6000! Mon Feb 02, 2015 2:12 pm

Re: Count Down to 6000! Mon Feb 02, 2015 2:22 pm

Re: Count Down to 6000! Mon Feb 02, 2015 2:22 pm

Re: Count Down to 6000! Mon Feb 02, 2015 2:26 pm

Re: Count Down to 6000! Mon Feb 02, 2015 2:26 pm

Gainer wrote:Today is the end of falling

Re: Count Down to 6000! Mon Feb 02, 2015 2:46 pm

Re: Count Down to 6000! Mon Feb 02, 2015 2:46 pm

Re: Count Down to 6000! Mon Feb 02, 2015 9:57 pm

Re: Count Down to 6000! Mon Feb 02, 2015 9:57 pm

Re: Count Down to 6000! Mon Feb 02, 2015 10:13 pm

Re: Count Down to 6000! Mon Feb 02, 2015 10:13 pm

Re: Count Down to 6000! Mon Feb 02, 2015 10:25 pm

Re: Count Down to 6000! Mon Feb 02, 2015 10:25 pm

Go to page : 1, 2

Similar topics

Permissions in this forum:

You cannot reply to topics in this forum