Equityinvestor wrote:Nigesh Pereira@CSE_watch wrote:There will be too many glove producers

In Malaysia (and Thailand, China ...) several companies are diversifying into glove manufacturing:

https://www.theedgemarkets.com/article/luster-hang-seng-latest-jump-rubber-glove-bandwagon

https://www.theedgemarkets.com/article/klci-pares-loss-mah-sing-new-darling-investors

Valuations for glove producers are sky-high in Malaysia and this attracts numerous newcomers to this sector. Everybody is flush with money and glove factories in Malaysia are expanding at a record pace.

This means that in some time, there will be an enormous glut in glove manufacturing. Glove making will be much less profitable than today. Once the market realizes this, stocks of glove producers will fall as fast as they have risen.

Dhammika Perera / HAYL should sell DIPD now (or at least its Thailand glove factory) before it is too late.

Don't get carried away by buying DIPD.

Mr Perera needs to buy some dipd.

Hi all,

It is good to different perspective by different people.

What is important to identify is VALIDITY of the point making the increase in supply of gloves,which I don't view as a major challenge to Dipped Products Plc.

Why?

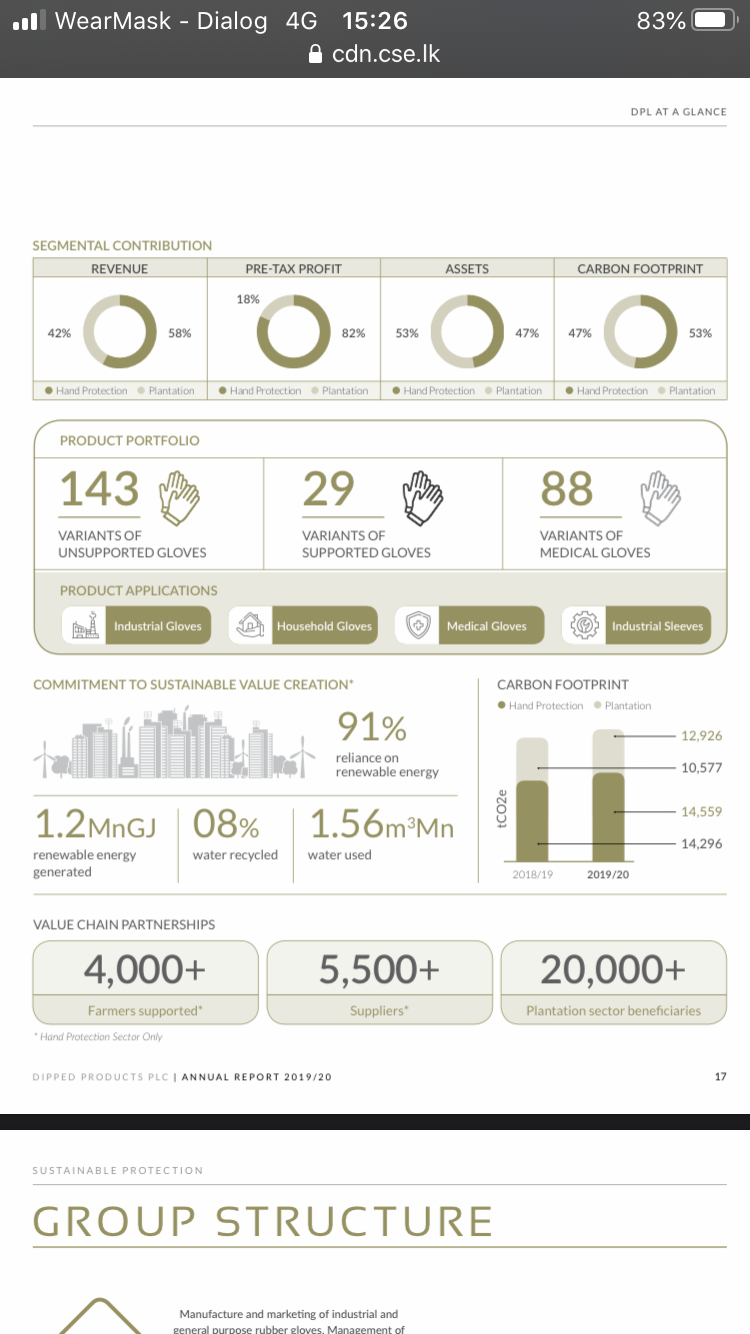

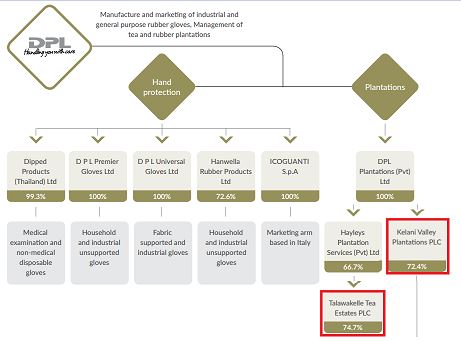

1. High level of expertise and over 40 years of experience of DIPD - Established in 1976, Dipped Products is one of the leading non-medical/medical rubber glove manufacturers in the world, and accounts for a 5% share of the global market. The company’s products now reach 70 countries.

2. Incremental growth for RUBBER GLOVE DEMAND globally - The following factors are likely to contribute to the growth of the medical gloves demand incrementally during next 4-5 years:

1. Emergence of New Pandemic Challenge

2. Ensuring Post Pandemic Safety measures which recommended by medical professional as custom for all individuals globally

3. Progressive Emphasis on Stringent Health Regulations across Europe, USA Regions whom are highly sensitive for COVID19 development

4. Increased Focus on Safety and Hygiene Standards

5. Growth in Surgical Procedures

3. DIPD sales mainly contributed by COVID19 led demand and US/China Trade war which shifted many orders from China to Sri Lanka and Thailand factories.

However, there can be new supplies to any industries with incremental demand. However, what we have to understand is the entry barriers or challenges in producing nitrile gloves and other glove types. The following are the main ones which I listed

1. Because vinyl is an inherently weaker material than latex, it was necessary to develop separate, less stringent requirements for vinyl glove performance certified by standards such as ASTM, 2001a; 2001b; 2000

2. Given the differences in in-use barrier durability, it is evident that health-care personnel should select gloves with the barrier durability appropriate for the task at hand.

SIGNIFICANT EARNINGS GROWTH CONTRIBUTORS OF "DIPD"

NO NEW ORDERS are taken till 2022 and the cash flow for the financial year is secured well ahead. If you have any GLOVE ORDERS call and see.

Hence, it has taken 40+ years for DIPD to capture 5% market share globally. Therefore, it is not easy as you described for a new player to come and penetrate into a new market.

Concluding Remarks -

DIPD will deliver the INDUSTRY BEST RESULTS during 2020.

DIPD will be one of the COVID19 friendly company other than EXPO.

Both DIPD and EXPO are HARD TO FIND HIGH VALUED DIAMONDS with high levels of earnings potential in upcoming quarters selling 50% discount even at current prices. I would say "LET THE NUMBERS SPEAK in QUARTERLY EARNINGS"

What I suggest is to collect in large buckets at regular intervals which can help you to become wealthy without a doubt.

Good Luck

Disclaimer - This is not a BUY or SELL recommendation. Do your own analysis before making any decision.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home