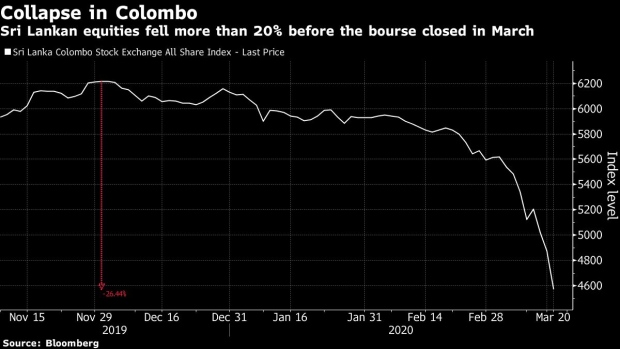

| Leading News from Sri Lanka:: Fri, May 8, 2020, 09:12 am SL Time, ColomboPage News Desk, Sri Lanka.  May 08 (Bloomberg) Sri Lanka’s stock market is set to resume trading Monday after its longest ever shut down aimed at combating the pandemic, while the Bangladesh bourse has yet to flag a reopening. Foreign funds, however, may have lost interest during the prolonged wait. “It leaves a bitter taste,” Hasnain Malik, head of equity strategy at Tellimer in Dubai said of the Bangladesh bourse shutdown. “Many foreigners will be put off by the ad hoc closure of the market for such a long period.” Sri Lanka and Bangladesh exchanges are among a handful of global stock markets that halted trading in March after the coronavirus contagion shut down economies and hammered equities. Investors in these markets missed out on a worldwide rebound in equities in April. The island nation’s stock gauge is down more than 20% from its most recent peak in December, while Bangladesh equities last traded on March 25 and are marking their longest closure since 1976. The seven-week “closure of the Colombo Stock Exchange will likely affect short term sentiment toward Sri Lankan equities once markets do re-open as selling pressure would have built up,” said Ruchir Desai, a fund manager at Asia Frontier Capital Ltd. in Hong Kong. Some foreign investors had raised their concerns about the extended closure via intermediaries to the regulator, Desai said. Curbs on imports of non-essential goods and capital outflows were also imposed in March to preserve foreign exchange as the rupee dropped to consecutive record lows. Sri Lanka had registered 797 coronavirus infections and nine deaths, while Bangladesh had 12,425 cases and 186 fatalities, according to data compiled by John Hopkins University as of May 7. ‘Black Swan Risk’ “The Covid-19 pandemic is the essence of a black swan risk,” said Mattias Martinsson, chief investment officer of Tundra Fonder AB in Stockholm. “There will be a certain understanding of extreme action. In addition, investors in smaller emerging markets and frontier markets are aware that these markets can be more fragile during times like these.” Tundra plans to retain its holding in Bangladesh pharmaceutical shares when trading resumes as valuations are “attractive,” Martinsson said. Still, extended closures of stock markets would have “long lasting consequences”, which could result in stocks “getting kicked out from global indexes like MSCI,” said Thomas Hugger, chief executive officer at Hong Kong-based Asia Frontier Capital, which has equity assets in frontier markets including Sri Lanka and Bangladesh. MSCI Inc. won’t implement any changes resulting from its May 2020 Semi-Annual Index Review for Sri Lanka and Bangladesh securities in MSCI country or composite indexes that they’re a component of due to the prolonged exchange closures, it said in a statement dated May 6. Changes not implemented would be deferred to its August quarterly review. In Sri Lanka, foreign investors haven’t been net equity buyers since last year’s third quarter. Overseas funds, which account for about a third of market volume according to the market regulator, have sold net $28.8 million of local equities so far this year. The Colombo All-Share Index is at its lowest level in almost a decade and trades at a price earnings multiple of 8.41. The island’s curfew restrictions would have led to “lots of practical problems,” especially post-transactions, if the market hadn’t been shuttered, said Dimuthu Abeyesekera, chief executive officer at stock brokerage Asha Securities Ltd. in Colombo. The Securities and Exchange Commission of Sri Lanka “fully understands the impact and possible consequences of the inability to re-open the stock market and the need to recommence market activities at the earliest,” the regulator said in an emailed response to queries. Efforts to cushion a selloff on reopening with three tiers of circuit breakers replacing one at the Sri Lankan market’s reopening may help curb a further collapse in stocks in the face of excessive selling, said Kavinda Perera, head of research at Asia Securities Pvt. in Colombo, while Tallimer’s Malik doesn’t expect a rush to withdraw from Bangladesh. “It will be a gradual, long-lasting withdrawal by foreigners,” said Tellimer’s Malik. “Perhaps, a persistent overhang for the market.” :copyright:2020 Bloomberg L.P. |

Registration with the Sri Lanka FINANCIAL CHRONICLE

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc.. All information contained in this forum is subject to Disclaimer Notice published.

Thank You

FINANCIAL CHRONICLE

www.srilankachronicle.com

Home

Home