CSE has 284 Listed Companies, classified using Global Industry Classification Standard (GICS) into 19 Industry groups and 10 sectors. Among these we have 279Equity Listed companies, 05 Debt-only Listed companies and 29 Debt and Equity listed companies.

We have 03 Trading Boards namely,Main Board [82.1% of Market Cap] for the largest companies, the Dirisavi Board [17.0% of Market Cap] and theEmpower Board which is for SME and start-up companies. The CSE has 2 Indices, the All Share Price Index (ASPI) [Up 8.3 % YTD] and the S&P SL20 [Up 12.0% YTD].

Now Let’s have a look at the performance of the Colombo Stock Exchange

The CSE All Share Price Index has continued to perform well relative to the emerging and frontier market world and CSE has Rebounded strongly since the depths of the pandemic. The Policy environment is conducive to strong valuations with lowinterest rates. We see an active local market participation and we are reinforcing proactive efforts to educate and promote the market while managing the risks locally by CSE and SEC.

If we consider what sectors of the economy are represented on the CSE you see a good representation of sectors. Some sectors such as Logistics & Transportation, Real Estate, Retailing and IT are underrepresented. But they are captured within conglomerates and we also have a good pipeline of IPOsof companies representing these sectors.

Investor participation at the CSE has changed since the pandemic and not unlike many other emerging markets. Foreign investor participation has fallen from 44% of trading turnover in 2018 to 8% this year. At the same time, domestic individuals which represented 22% of turnover in 2018 have grown its share to 56% this year. The market trading characteristics however have shown the depth of the local investor base given the right environment such as low interest rates and easier access to the exchange due to recent digitalization efforts.

When we speak of how foreign investor friendly the CSE is, the process of investing in the Sri Lankan stock market is very easy for a foreign investor. Foreigners have been able to freely trade in the CSE since 1992. You can open asecurities account in the CDS through a participant organization (Stockbroker or Custodian Bank), then submit duly completed Client Account Opening Forms, togetherwith the relevant supporting documents. After scrutinizing the account opening documents, inclusive of the supporting documents, theCDS will register the applicant in the CDS system and inform the CDS participant of the account opening within days.

With regards to Funds movement, we have Inward Investment Account (IIA) at CSE. IIA is a special account designated for eligible investors resident in or outside Sri Lanka to route funds to invest in the permitted investments. Licensed Commercial Banks and Licensed Specialized Banks (as permitted) are permitted to open and maintain IIA in the Domestic Banking. If investment funds are brought in through the IIA, then all returns to the investor including dividends or sale proceeds will be remittable via same IIA with no further currency approvals. The IIA and its predecessor mechanism has existed since 1992 and operated without exception.

We have a viable Tax regime for Foreign Investors includingNo Capital Gains Tax and No Dividend Tax imposed on Foreign Investors.

It is also important to note that strict but suitable corporate governance rules have been part of listing rules since 2008. This is an area where we constantly coordinate with the regulator - the Securities & Exchange Commission of Sri Lanka(SEC), to ensure that governance and investor protection are paramount within our listed company framework. Among other matters, our Corporate Governance framework focuses on timely disclosures, Corporate Governance rules and adherence to International Accounting standards. In addition, the CSE is very focused on encouraging and driving sustainability goals and has been a part of the United Nations Sustainable Stock Exchanges Initiative.

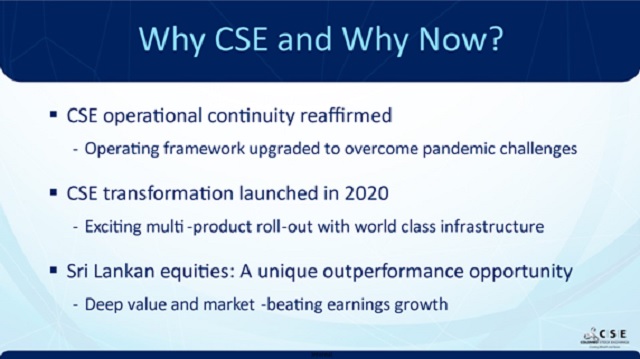

I might add a word something that experienced investors on the CSE may be wondering about – which is the Market Closure in 2020.While I don’t want to dwell on this as it is a past issue, it is important to say the following. We were challenged by an operating scenario that market participants were not fully prepared for. But the good news is that we were quick to learn some important lessons from it, swift to move towards Digitalization of not only the CSE’soperations but its interactions with market participants and investors as well. In addition, following a tremendous effort which was a very compelling display of the dynamism of the market operator and regulator, rules and operating procedures were established to enable CSE to operate under any circumstance during which the banking system was operating. Proof for this success includes having had multiple situations since the Digitalization where through multiple curfews, lockdowns and travel restrictions required to mitigate the impact of the pandemic, the CSE and its member firms have operated seamlessly.

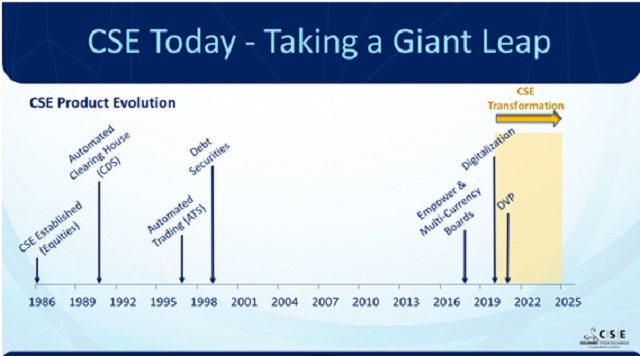

What I really want to talk about today is also why I am extremely excited to be a part of this organization at this time. CSE has provided a strong foundation for equity and corporate debt financing and trading over its 35 -year history. While economic winds have shifted, even through the extended civil war that ended 12 years ago, the CSE continued to be the primary venue for channeling funds to private companies while offering an attractive investment venue to investors.

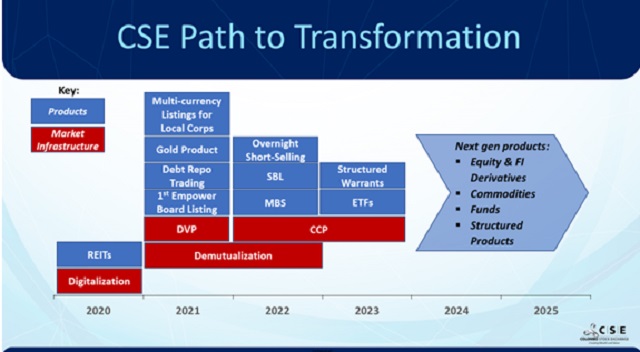

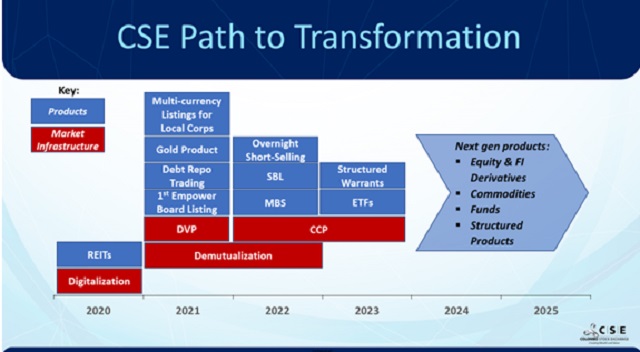

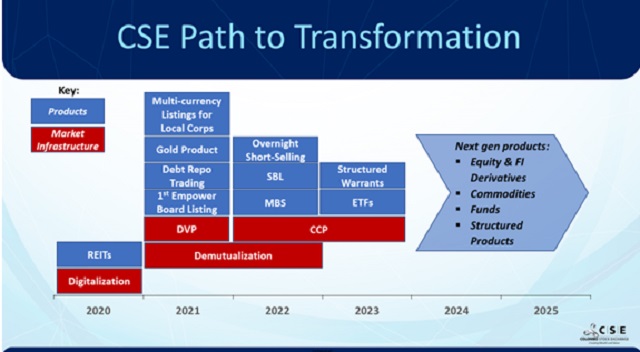

However, this market in regional or global context, has been somewhat more limited in its number and diversity of product offerings.Why it is the right time for you all to engage with the CSE, is the ambitious transformation program currently underway at the CSE which is expected to move it significantly – and in our aspiration, take a quantum leap – towards a much more comprehensive and multi-product securities exchange.

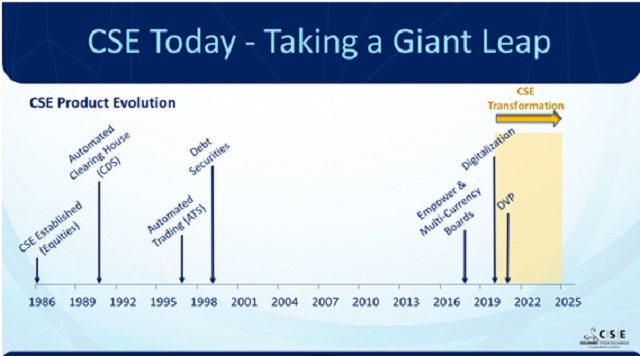

This exchange was one of the earliest in the world to embrace technology and was in select company when it launched the automated clearing house in 1991.

Then in 2020, we took very deliberate steps to advance and transform this market.In addition to various efforts to support these strategic goals, we know that solving many strategic challenges of users of the CSE (ie, both issuers and investors) will only come from establishing a wider, more comprehensive suite of products and solutions at the exchange. We are currently working very closely with the capital markets regulator, the Securities & Exchange Commission of Sri Lanka (SEC) as well as other policy institutions such as the Ministry of Finance (MOF), Central Bank of Sri Lanka (CBSL) as well as key related financial sector participants like the banking system, to as well as many strategic partners on the technology and exchange space to accelerate and achieve our objectives.

As the final segment of my speech, I would like to reflect briefly on the current opportunity available on the CSE namely the very attractive valuations and outlook in the equity market. There are o4 Key points to be established in this regard. First valuations are very low relative to earnings capacity of listed companies. Relative to other markets it is cheap. Even in historical context, the difference, or as is the case currently, the discount to relevant market indices shows a wider discount than seen in the recent past. In addition, this may be a result of significant FII outflows since the onset of the pandemic and this implies that even if there are any specific risks that investors have worried about, risk adjusted pricing in the market look very low and very attractive.

Secondly earnings momentum in recent quarters has far outpaced that of benchmark indices asthe local policy environment – including low interest rates and incentives for domestic manufacturing - created the impetus for many listed companies to outperform.

Thirdly price movement in the CSE’s ASPI has also had little correlation with other major indices. This provides a great opportunity to add some diversificationto you equity portfolios and this is particularly interesting at a time when there seems to be deep value and a strong earnings outlook.

Fourth and last point is that traditional concern about the CSE has been Liquidityand this has also changed. While average daily trading turnover on the CSE stood around the US$4-5mil/day, 3 or 4 years ago, last year this was over US$10mil/day and this year that has doubled to US$23mil/day. Interestingly, the number of stocks trading large volumes daily as also risen. In the years before 2020, between 8 and 14 companies traded over US$100,000/day on the CSE. This year we have seen that number go up to 37 stocks. This provides many more investment options on the CSE especially to foreign investors.

So I hope you have received a fairly good and relevant overview of the CSE and the opportunity for participating in a capital market with ambitious growth plans.

In summary, I would like to close with three key messages for you.

Hope you will take a very good look at the opportunities available at the CSE, Leverage the many resources that will be available to you through materials from this investor forum, resources available to you at the CSE as well as all its market intermediaries.

We are very excited about the years ahead in the Sri Lankan capital market. We hope you will join us in this journey and recognize the potential it offers to your investment portfolios.

http://www.slguardian.org/2021/06/colombo-stock-exchange-towards-quantum.html

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..