Maharaja Foods Limited (MFL) is set to launch its Initial Public Offering (IPO) with the goal of raising LKR 125 million by issuing 25 million ordinary voting shares at LKR 5.00 per share. While the IPO presents an opportunity for potential investors, several concerns surrounding the pricing and underlying assumptions suggest caution.

Overvaluation Concerns

Discrepancies in Valuation Methods: The IPO price of LKR 5.00 per share is derived through various valuation methods, primarily based on Price Earnings (P/E) multiples and Discounted Cash Flow (DCF) analysis. However, the valuations exhibit significant variances. The P/E multiple suggests a valuation of LKR 5.73 per share, indicating a discount of 14.6%, while the DCF method yields a value of LKR 4.91 per share, showing a premium of 1.8%. This discrepancy highlights the inherent uncertainty and lack of consensus on the company's true market value.

High P/E Ratio Compared to Industry: The proposed P/E ratio for Maharaja Foods stands at 16.1 times based on FY 2024 earnings, significantly higher than the industry average P/E multiple of 8.28 times for the Food, Beverage & Tobacco sector and 14.93 times for the Food Staples Retailing sector. This overvaluation raises concerns about the sustainability of such high multiples, especially in a competitive market.

Financial Performance and Risks

Low Net Asset Value (NAV): The NAV per share for Maharaja Foods as of March 31, 2024, is LKR 0.94, making the issue price 5.31 times the NAV. Even after adjusting for IPO proceeds, the post-IPO NAV stands at LKR 1.75 per share, resulting in a P/BV of 2.86 times. This indicates that the shares are being offered at a substantial premium to their book value, which may not be justified given the company’s financials.

High Dependency on Debt: The company has relied heavily on borrowings for both capital expenditure and working capital requirements. The IPO aims to partially settle these borrowings, which may reduce future interest costs. However, the substantial reliance on debt in the past raises questions about the company’s ability to manage its finances efficiently and its potential vulnerability to interest rate fluctuations.

Operational and Market Risks

Exposure to Price Fluctuations: Maharaja Foods plans to set up a raw rice plant and a rice polishing plant to mitigate adverse impacts from raw rice supplier price fluctuations. However, the success of this backward integration strategy is uncertain, and the company may still face challenges related to market price escalations and supply chain disruptions.

Dependence on Export Markets: The company’s primary markets are overseas, including France, the UK, Australia, and Singapore. This dependence exposes Maharaja Foods to geopolitical risks, currency fluctuations, and changes in trade policies, which could adversely affect its revenue and profitability.

Execution Risks

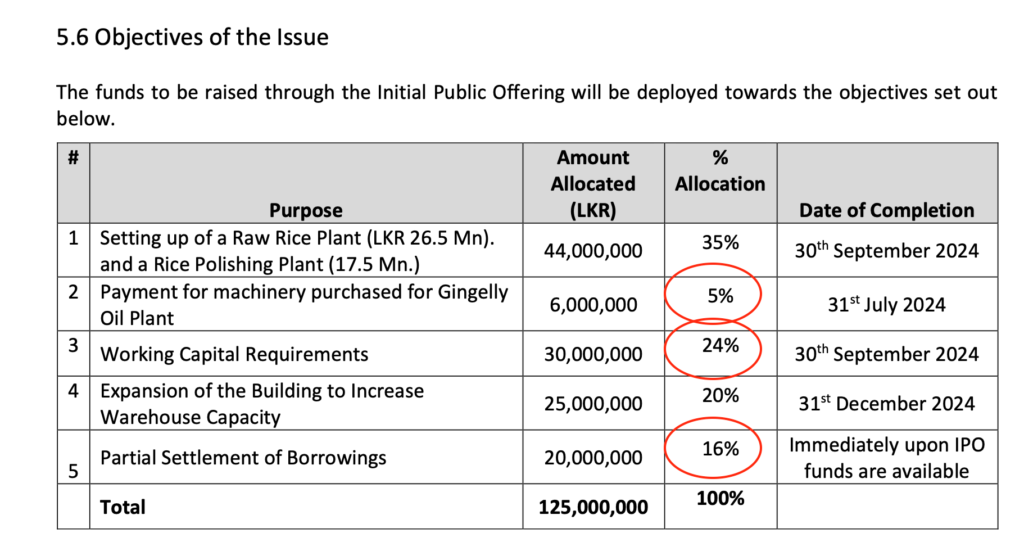

Use of IPO Proceeds: While the company has outlined specific objectives for the IPO proceeds, including setting up new plants, working capital requirements, and debt repayment, there is a risk that actual costs may exceed estimates. Any deviations from planned expenditures could impact the company’s ability to achieve its stated goals, thereby affecting future growth prospects.

Regulatory and Compliance Risks: Being listed on the Empower Board of the Colombo Stock Exchange brings additional regulatory compliance requirements. Any failure to adhere to these regulations could result in penalties or delisting, further impacting investor confidence and the company's market valuation.

Conclusion

While Maharaja Foods' IPO presents a potential investment opportunity, the concerns surrounding its pricing, financial health, operational dependencies, and execution risks suggest a cautious approach. Investors should carefully consider these factors and conduct thorough due diligence before making any investment decisions.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home