CSD announced a 1:1 Rights Issue @ a price of 11 and 73,982,430 Ordinary Voting Shares of the Company were listed on 27th June 2011 as a result.

Capital Infusion from rights = Rs 813,806,730/-. As per the quarterly financials of 30-06-11, the Company has also settled borrowings of Rs. 680,081,053.46 with the part of funds raised from this Rights Issue.

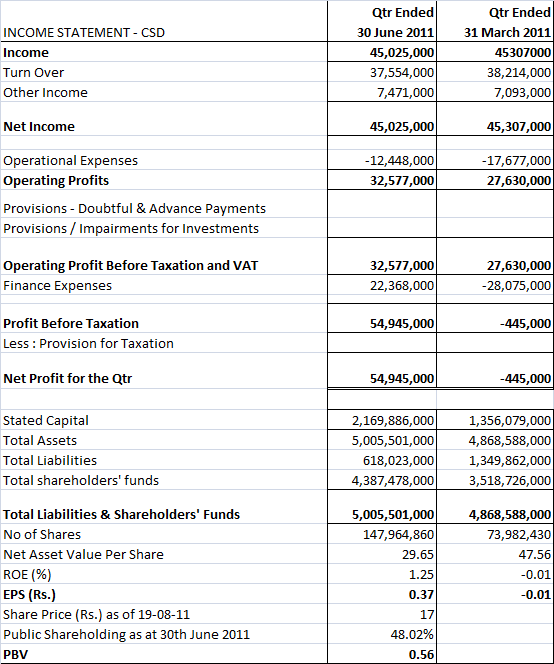

For the qtr ended 31/03/11 they've made a loss of 0.44 Mn but their NAV was 47.56 while they had a negative EPS value and the last qtr 30/06/11 they've come nack to profitability with a EPS of 0.37

During the year 2010 the property at No. 90, Galle Road, Colombo 03 - East Tower was reclassified as an Investment Property and the carried forward revaluation surplus was transferred to the retained earnings and restated the opening balance according in the 1st quarter 2011. The value of this is 4.59 Bil.

Interestingly after rights issue, the NAV of the company has fallen to 29.65 and considering the last close of 16.60 on 19-08-11, this is still trading under the NAV value.

Catch - AS you can see on the financial reports, the finance expense of 22.36 Mn has been entered as a + figure this qtr (while it was a to be deducted value last qtr) which I'm trying hard to find out why???????

Technical Charts at a Glance;

The following Chart was a combination of two trading systems, and the colorful ones were the popular indicator called "Alligator". According to this the momentum is still up by lips of the alligator being upwards but the signals to the left indicates the contrary as most of the signals are down.

At the bottom u can see the price breakout chart where it has evolved form 11.8 the lower level and touched 20.6 two times but failed to break out from that level upwards. So this is one resistance while we have some sort of support to be seen around 14-15.

Sometimes this can even come back to 15 or 16 before another run could be started and we need ASI to be stay green to trigger the market is moving up..

Nothing of this will give you a buy/sell indication of any sort and no emphasize has been taken to elaborate the same. Just analyse and take you decision.

P.S. I've got a small amount of CSD.

[/url]

[/url]

Last edited by smallville on Sun Aug 21, 2011 12:34 pm; edited 1 time in total (Reason for editing : Added Technical charts)

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home