Weak leisure sector hinders JKH 2Q earnings; consumer, retail segments gain momentum

The performance of Sri Lanka’s largest listed company, John Keells Holdings PLC (JKH) was hampered by its weak leisure sector operations hit by Easter Sunday attacks which dealt a crippling blow to the country’s booming tourism and hospitality industries.

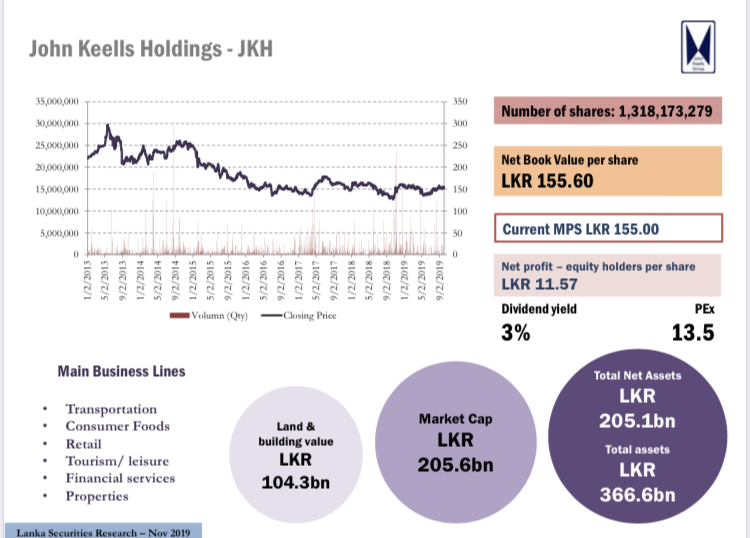

JKH reported earnings of Rs.1.74 a share or Rs.2.29 billion for the three months ended September 30, 2019 (2Q20) compared to earnings of Rs.3.67 a share or Rs.5.10 billion reported for the same period last year.

The growth in revenues languished at 3.0 percent year-on-year (YoY) to Rs.33.7 billion. For the six months ended September 30, 2019, JKH reported earnings of Rs.2.49 a share or Rs.3.28 billion compared to Rs.5.25 a share or Rs.7.28 billion a year ago.

The revenues grew by 4.0 percent YoY to Rs.65.4 billion.

The JKH share ended flat at Rs.157 on Friday’s market close.

The diversified group’s performance was also impacted by lower finance income resulting from the deployment of cash in new investments and the lower exchange gains recorded by the holdings company on its foreign currency denominated cash holdings.

“The group’s year-on-year performance for the quarter was impacted by the downturn in the group’s Sri Lankan leisure business which continued to be significantly impacted post the Easter Sunday terror attacks,” JKH Chairman Krishan Balendra said in an earnings release.

The leisure sector earnings before interest tax depreciation and amortization (EBIDA) sank to Rs.134.3 million in the quarter under review from Rs.1.14 billion in the same period last year.

However, the group is seeing an upward trend in the forward bookings and thus Balendra expects occupancy in the peak season to be in line with the previous year, albeit at a moderately lower room rate.

“However, despite the challenging operating environment, the city hotels sector maintained its fair share of available rooms in the 5-star category in the quarter under review,” he added.

During the quarter under review, the group added its fourth resort property, Cinnamon Velifushi Maldives to its Maldivian hotel portfolio. In connection to the Sri Lankan hospitality sector, the group will commence operations of its newly constructed Cinnamon Bentota Beach in December.

Meanwhile, during 2Q20, JKH saw some strong growth in its consumer foods and retail segments with its beverage and frozen confectionery business gaining traction while the customer footfall increased in the group’s supermarket chain, which now

has 100 outlets.

“The beverage and frozen confectionery businesses recorded encouraging double-digit growth in July and August. However, adverse weather conditions in many parts of the country in the month of September hampered distribution resulting in a muted volume growth for both categories for the quarter,” Balendra stated.

The group’s transportation business, mainly represented by its ports and shipping operations and South Asia Gateway Terminals (SAGT), was impacted by an operational disruption in August. However, the group’s bunkering business under Lanka Marine Services (LMS) recorded strong growth in profits driven by improved margins.

The transportation business EBITDA for the quarter was Rs.1.12 billion, little changed from Rs.1.15 billion a year ago.

Meanwhile, the quarter under review saw the first tranche of revenue recognition from JKH’s ‘Tri-Zen’ residential development project. “Revenue recognition of the project will ramp up over the next few quarters as the project progresses,” Balendra added.

The financial services sector of the group, which mainly consists of Union Assurance PLC and Nations Trust Bank PLC, saw a marginal decrease in its EBITDA to Rs.563 million.

“The performance Union Assurance PLC recorded a marginal decline whilst the gross written premiums demonstrated growth.

“Nations Trust Bank PLC recorded an improvement in profitability as a result of focused efforts on collections and a lower impairment charge compared to the corresponding quarter of the previous year,” Balendra stated.

With no controlling shareholder, S.E. Captain held 10.9 percent of the issued shares of JKH as the single largest shareholder as at September 30, 2019 while Broga Hill Investments Ltd., a special purpose investment vehicle of Malaysia’s sovereign wealth fund Khazanah Nasional Berhad held 10.8 percent stake in JKH.

Melstacorp PLC, controlled by business tycoon Harry Jayawardena, also held 9.8 percent of JKH being the company’s third single largest shareholder.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

Premier blue chip John Keells Holdings (JKH) has faced a challenging second quarter with its overall performance showing mixed results with some sectors improving and others lagging. JKH reported a 3% growth in Group revenue during the second quarter of the year of Rs. 33.7 billion. First half Group revenue was up 4% to Rs. 65.4 billion.

Premier blue chip John Keells Holdings (JKH) has faced a challenging second quarter with its overall performance showing mixed results with some sectors improving and others lagging. JKH reported a 3% growth in Group revenue during the second quarter of the year of Rs. 33.7 billion. First half Group revenue was up 4% to Rs. 65.4 billion.