ipoguru wrote:I found out the answers

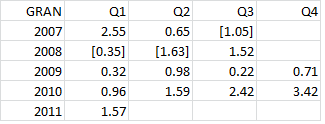

GRan 0.96 to 1.57 increase

TAFL 0.02 to 1.75 increase..

Second quarter and fourth quarter results should be better than this...

See following approximation of my PE analysis for GRAN

1.57+2.5+2+3 = 9.03 EPS ... So GRAN P/E will be 16 at current market price..

So no need to panic and sell..... I think market has already reacted to this quarterly results... Please comment.

First lets get the truth out.

- Am I and are we dissapointed with TAFL/GRAN results this quarter. YES. We who invested were all expecting more naturally.

- were there people warning about generalizing earnings based on December . YES. And I agreed then and now. Hats off to them.

Now, is the company going down the drain and should we panic My answer is NO. Not yet especially if you are Long term investor. But then again it really depends on the individual mentality and intention to panic.

Shorterm : The price has come down from a Rs 265 to Rs 145 now. I would say the current price is adjusted mostly to incorporate this off quarter issue. It appears the big investors had already done their selling including perpetual who got wind of this quarter issue and disposed part of their shares, which they bought at Rs 250.

Can there be further selling?

If one panics and base their assumption on this 1 quarter EPS then this should be valued at around Rs 100. Then again should we do so? Is it correct? If we do so it is contradictory to the same statement to annulize eps from December isn't it? Will there be people panicing and want to sell and will the price go down further. Maybe it depends on the person.

Below description is for Long term Investors ( who can hold for 1 year or more atleast. Not for short term traders) My advice is do not panic yet. Watch for further develpments from now and next quarter. TAFL and GRAN went through much harder times from from 2007 to early 2010. There are recovering and have growth plan which will take time to take effect. As IPOGuru and Econ mentioned their year to year growth is not bad. It just quarter to quarter is bad.

The reason as mentioned on GRAN report,

"As the local maize production was badly affected by the unfavorable weather conditions early this year and the Government restriction on importation of maize still continues, the sourcing of the main raw material has become a major challenge for the poultry industry.

In spite of high raw material prices, the company was able to make a profit during the period under review mainly due to its cost effective feed formulation & efficient operations."

ALso notice on the report NOTE

EPF has roughly 5 million shares

Laugf Gas limited has 1 miilion Perpetual still has collectively about 1.1 million

Nimal Perera has 0.4 million.

I am not sure whether the latter 2 sold again but EPF and Laugf might go for long term on this. They still have a reason. If EPF and Laugf quits next quarter I would be worried more.

Finally a note to my fellow investors: Folks lets pull our selves together here.None of us are perfect. We are volunteerign our free time to comment and help here. I don;t beleive any of us professionals and even if so nobody can predict market 100% though they may claim to do so falsely . Please do not blame others ( unless someone insults and abuses what you say where I leave the judgement upto you.

Finally, let us be united in anothers time of misery and help each other and not prove who is right and who is wrong to show superiority.

We all have made mistakes. But is GRAN/TAFL a mistake for long term? People who warned about GRAN /TAFL situation in the short term thank you for you insight.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home